PSI is founded under the Industrial Development Income Tax Relief. Unabsorbed losses not to be carried forward to post-pioneer period.

Chapter 5 Investment Incentives

In need of new products or repair of currentones.

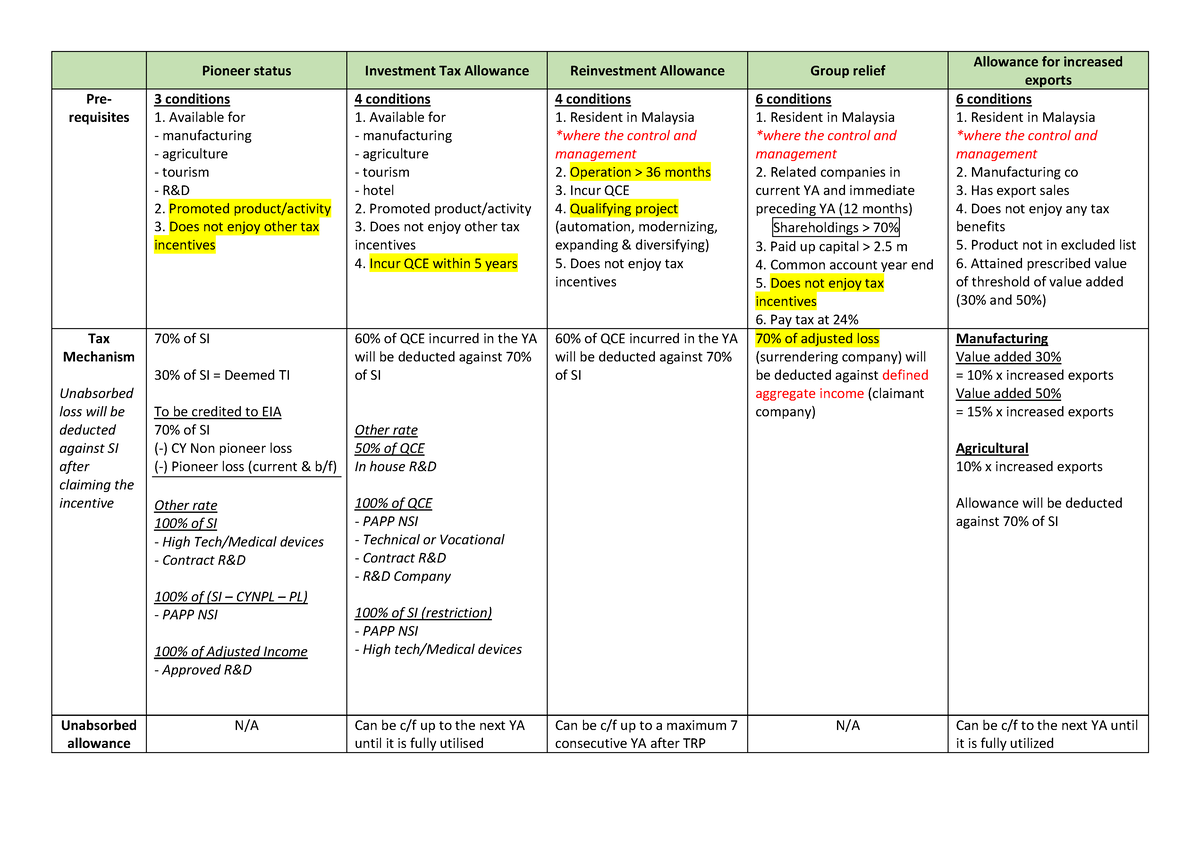

. While pioneer status is an income-based tax incentive investment tax allowance is a capital expenditure-based one that generally provides for a deduction over and above capital allowances equivalent to 60 of the qualifying expenditure. The manufacturing operations commenced. Find the nearest dealerships to you.

Simply open the app using any smartphone or tablet to generate a new travel and tourism application checklist and youll be prompted to run through a variety of questions. Tax exemption of statutory income for 10 years. Step 2 Your application will be reviewed for a preliminary check.

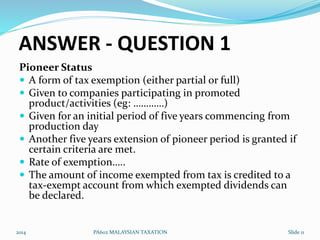

Pioneer status often provides a 70 exemption of statutory income for a period of 5 years but it is possible to extend both the quantum and the period of the exemption. Malaysia grants this ten-year incentive to companies in promoted fields such as RD tourism hospitality manufacturing or technical training. It pays tax on 30 of its statutory income with the exemption period commencing from its Production Day defined as the day its.

Pioneer Status PS is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years. High technology companies can apply for pioneer status being defined as companies in which at least 7 of the work force are science and technical graduates and of which research and development costs amount to 1 of gross sales. Pioneer status PS and investment tax allowance ITA Companies in the manufacturing agricultural and hotel and tourism sectors or any other industrial or commercial sector that participate in a promoted activity or produce a promoted product may be eligible for either PS or ITA.

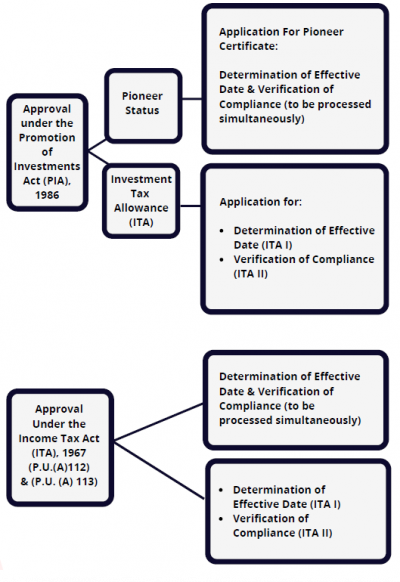

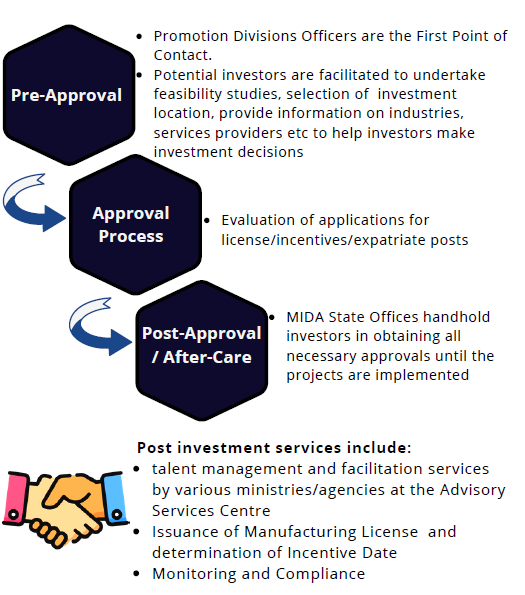

Taxation 2 pioneer status exercise new word class exercise pioneer status alam sdn accounting year ends on 31 december. Overview of Pioneer Status Incentive 21. Application for Pioneer Certificate Companies can now submit their applications for Pioneer Certificate and track its status online via InvestMalaysia Portal at investmalaysiamidagovmy.

Pioneer Status is a status granted by The Malaysian Investment Development Authority with the aim to transform Malaysias best and most promising businesses into the most competitive enterprises in global export markets. It may provide up to 10 years of tax holiday. Not applicable Contract RD companies that provide RD services in Malaysia are eligible for an income tax exemption 100 tax exemption on statutory income 100 tax exemption on statutory income RD.

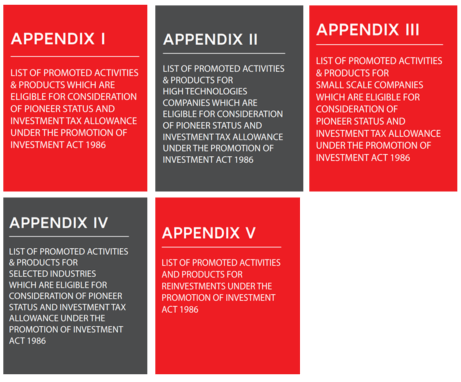

The alternative to pioneer status incentive is usually the investment tax allowance ITA. Pioneer status General It is possible for a company to be granted PS by MIDA for multiple promoted products or promoted activities with their respective TRPs commencing and ending on different dates. Application for Determination of Effective Date of the Investment Tax Allowance Incentive GUIDELINES APPLY HERE 3.

100 of the statutory income of high technology companies is exempted from tax for a period of 5 years. Approval of pioneer status by a company producing a product or participating in an activity of national and strategic importance to Malaysia. With the Malaysian tourism and hospitality app its easy to make sure that applications for Pioneer status are fully completed before being submitted to the government.

You dont have any courses yet. You dont have any books yet. Formulation of policies and coordination of all stakeholders to enable an innovative and vibrant digital economy ecosystem Creation of local entrepreneurs and global champions to increase contribution from the digital economy to GDP.

I Pioneer Status A company granted Pioneer Status enjoys a 5-year partial exemption from the payment of income tax. As shown in the MDEC website for those looking to apply for the MSC Malaysia status here are the steps that you will need to go through- Step 1 Click Apply MSC Status to register your account and complete the online application form within 30 working days. You dont have any Studylists yet.

Pioneer status often provides a 70 exemption of statutory income for a period of 5 years. THK Management Advisory Sdn Bhd - Pioneer Status Incentive - Jun 08 2022 Johor Bahru JB Malaysia Taman Molek Service THK Management Advisory - Our accounting firm specializes in company secretarial practice HR payroll services outsourced bookkeeping and accounting services. Not applicable Companies that incur operating expenses for qualifying.

200 super deduction National. GUIDELINES APPLY HERE 2. Unabsorbed capital allowances not to be carried forward to post-pioneer period.

The production day is significant as it marks the commencement of the PS ie the TRP subsists for exactly five years from the production day. Pioneer Status Incentive is a tax holiday which grants qualifying industries and products relief from the payment of corporate income tax for an initial period of three years extendable for one or two additional years. As the world moves rapidly MDEC continues to focus on leading Malaysias digital economy forward by accelerating.

This incentive reduces the amount of taxable income by 70 reducing these companies effective corporate tax rate to just 30 of the usual level during this period.

Promoted Activities Mida Malaysian Investment Development Authority

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Chapter 5 Investment Incentives

Getting To Know The Licensing And Incentive Compliance Monitoring Pppg Function Of Mida Mida Malaysian Investment Development Authority

What Is Msc Malaysia And How To Apply For Msc Status Mishu

Tax Incentives For Research And Development In Malaysia Acca Global

Chapter 5 Investment Incentives

Ps Ita Ra Gr Ea Taxation 2 Pioneer Status Tax Incentives Allowance Pioneer Status Investment Studocu

Tax Incentives For Research And Development In Malaysia Acca Global

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Wan Jun Pioneer Status Ps Given Through Partial Exemption From Payment Of Income Tax 70 Of Statutory Income Si Exempted While Other 30 Taxed Course Hero

Msc Malaysia Status Company Hd Png Download Kindpng

Getting To Know The Licensing And Incentive Compliance Monitoring Pppg Function Of Mida Mida Malaysian Investment Development Authority

Pdf The Utilisation Of Tax Investment Incentives On Environmental Protection Activities Among Malaysian Companies